FDA Warns Consumers of Nationwide Recall of Tainted Euphoric Capsules

- May 2, 2018

- Noah K. Wood

- Consumer Fraud Dangerous Products

The FDA announced Overland Park, Kansas based Epic Products, LLC is recalling all lots of Euphoric capsules after an FDA analysis found samples of the capsules to be tainted with undeclared prescription drug products. The FDA found samples tainted with undeclared sildenafil and tadalafil, also known as...

98 Million Unwanted Robocalls a Day Reports USA Today

- April 23, 2018

- Noah K. Wood

- Telemarketing and Privacy

USA Today reports United States consumers receive an estimated 98 million robocalls each day and fraud from these unwanted calls amounts to $9.5 billion annually. The April 20 article by Jennifer Jolly surveys options available to consumers including phone based spam blockers or apps available from wireless...

Customers Unite to Bring Class Action Against Butterfly Labs

- April 7, 2014

- Noah K. Wood

- Consumer Fraud

The Wood Law Firm LLC announced today that customers from across the country have joined together and filed a class-action lawsuit challenging the sales and advertising practices of Butterfly Labs. The lawsuit against BF Labs, Inc., which does business as Butterfly Labs seeks compensation for customers who...

Kevin Trudeau Sentenced to 10 Years in Prison for Defrauding Consumers

- March 18, 2014

- Noah K. Wood

- Consumer Fraud

TV Pitchman Kevin Trudeau was sentenced to 10 years in prison today for criminal contempt after continuing to scam consumers through infomercials and marketing his book "The Weight Loss Cure 'They' Don't Want You to Know About". United States District Judge Ronald Guzman noted "since his 20s, [Trudeau] has...

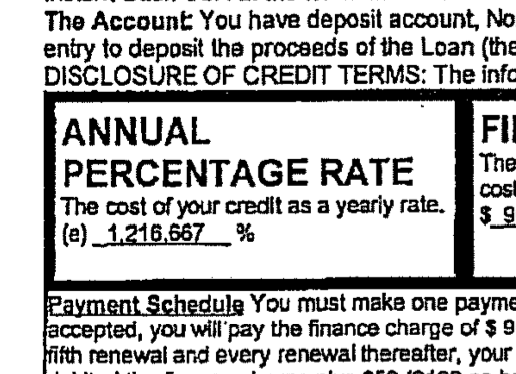

U.S. Court upholds FTC jurisdiction over "Indian" payday loan schemes

- March 18, 2014

- Noah K. Wood

- Debt Collection Abuse Consumer Fraud

In an FTC lawsuit targeting illegal payday loan operations which have affliated themselves with American Indian Tribes, the United States District Court for the District of Nevada has upheld an earlier recommendation finding the FTC has the authority to bring suit against Indian Tribes, arms of Indian Tribes,...

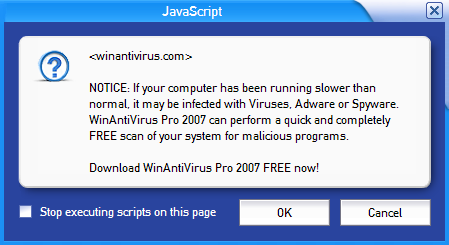

Federal Court of Appeals Uphold $163 million Judgment Against "Scareware" Scam

- March 5, 2014

- Noah K. Wood

- Consumer Fraud

The United States Court of Appeals for the Fourth Circuit has upheld a judgment of $163,167,539 against Innovative Marketing, Inc., the operator of a computer "scare-ware" scam which tricked consumers into thinking their computers were infected with malware, and then took money to "fix" the non-existent...

New Jersey Federal Court Approves TCPA Junk Fax Class Action

- October 16, 2013

- Telemarketing and Privacy

United States District Judge Stanley Chesler of the District of New Jersey has granted class certification of a lawsuit filed on behalf of the recipients of junk faxes, finding the "class action is simply a better available method to fairly and efficiently resolve the claims [...] in this case".The class...

New Robocall Rules Take Effect October 16

- October 15, 2013

- Telemarketing and Privacy

On October 16, 2013, new rules and regulations under the Telephone Consumer Protection Act (the "TCPA"), requiring prior express written consent for autodialed telemarketing calls to cell phones and prerecorded messages will take effect. These new rules are intended to protect consumers from unwanted...

Crest Toothpaste Settlement Offering Consumers Refunds Approved.

- October 15, 2013

- Consumer Fraud

United States District Judge Jose Linares of the District of New Jersey gave final approval to a class action lawsuit which accused Proctor & Gamble of making false claims on the label of Crest Sensitivity Treatment and Protection toothpaste.Proctor & Gamble advertised the Crest Sensitivity toothpaste provided...

Lose your rights by browsing a website?

- October 10, 2013

- Consumer Fraud

The United States District Court in Nevada has struck down an especially unfair and sneaky arbitration clause. Paul Bland at Public Justice has an excellent summary of the decision and the clause Zappos attempted to use to avoid coming to court. Zappos' "Terms of Use" provided that if a consumer simply browsed...

Washington Post interviews Director of Consumer Financial Protection Bureau

- October 10, 2013

- Debt Collection Abuse Consumer Fraud

Today's Washington Post published an interview with the Richard Cordray, the first director of the Consumer Financial Protection Bureau. He discusses some of the challenges facing the new agency and regulatory direction the agency is taking, including the current status of the bureau's supervision of the...

Federal Judge Denies Tribal Shield for Payday Loan Investigation

- October 4, 2013

- Debt Collection Abuse Consumer Fraud

Calling arguments by American Indian tribes "built [on] a wobbly foundation", Judge Richard Sullivan of the United States District Court for the Southern District of New York, denied several tribes' attempts to limit a crackdown by Benjamin Lawsky, superintendent of New York's Department of Financial...

Bank of America to pay $32 million for Robocalls

- October 2, 2013

- Noah K. Wood

- Debt Collection Abuse Telemarketing and Privacy

Bank of America has agreed to pay $32 million to settle a lawsuit accusing the bank of making harassing debt collection robocalls to customers' cell phones. Bank of American was accused of violating the Telephone Consumer Protection Act (the "TCPA"). The settlement will also require Bank of America to stop...

Takeda Failed to Warn About Actos Cancer Risks, Jury Finds

- October 2, 2013

- Dangerous Products

Takeda Pharmaceutial Co. failed to properly warn a patient and his treating doctor about the risk of the drug Actos the jury found in a Maryland trial. The jury order the company to pay $1.7 million in damages for the death of the patient. Although the trial Judge set aside the verdict based on a finding the...

U.S. FDA announces system to help device recalls

- October 1, 2013

- Dangerous Products

The U.S. Food and Drug Adminstration announced it is taking steps to implement a rule that promises to help quickly and efficiently identify recalled medical devices. The new rule for unique device identification (UDI) systems has the potential to identify problem devices faster, better target recalls, and...

Debt Collector to Pay $1 Million for Illegal Text Messages

- September 29, 2013

- Noah K. Wood

- Debt Collection Abuse Consumer Fraud Telemarketing and Privacy

A California debt collection company must pay $1 million to settle claims by the Federal Trade Comission related to using text messages in an unlawful attempt to collect debts. The California company, using the names National Attorney Collection Services, Inc. and National Attorney Services, LLC, are...

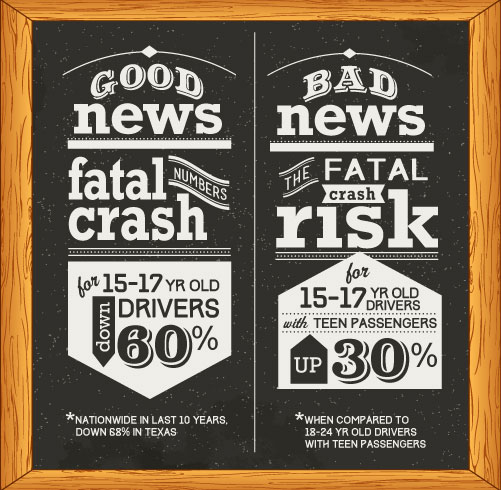

Study finds teens driving with teens increase risk of fatal crashes

- September 29, 2013

- Serious Injuries

A study by the Texas Transportation Institute has concluded the risk of a fatal crash has increased for teens who drive with peers. The research study found novice teenage drivers (age 15-17) are approximately eight times more likely than young adult drivers (age 18-24) to have a fatal crash if teenage...

Jason Kander Halts Securities Scam Targeting Missouri Seniors

- September 26, 2013

- Consumer Fraud

Missouri Secretary of State Jason Kander announced his office has stopped a fraudulent scheme that cost Missouri and Kansas residents more than $154,000.A Florida man, was not a registered investment adviser or broker-dealer, lured the victims using "free meal" seminars he hosted, where he represented himself...

Consumer Protection Bureau joins FTC in brief supporting consumers

- September 26, 2013

- Debt Collection Abuse Consumer Fraud

The Consumer Financial Protection Bureau (CFPB) joined the Federal Trade Commission (FTC) in filing an amicus brief in a case involving threats by debt collectors based on time-barred debts. The filing argues that actual or threatened litigation is not a necessary predicate for a violation of the Fair Debt...

Missouri Supreme Court rules insurer obligated on TCPA claim

- September 26, 2013

- Insurance Disputes Telemarketing and Privacy

The Missouri Supreme Court has ruled an insurance company wrongfully refused to defend its policyholder in a class action lawsuit for violations of the Telephone Consumer Protection Act (TCPA). The insured sent 12,500 unsolicited facsimile advertisements -- junk faxes -- to Missourians in 2001. A recipient of...

FTC Files Suit Against Sweepstakes Scam

- September 25, 2013

- Consumer Fraud

The Federal Trade Commission filed a lawsuit today against a sweepstakes scam that has taken more than $11 million from consumers. The FTC lawsuit alleges a California resident througha web of companies mass mailed letters to millions of consumers promising millions of dollars in prizes if they send in a...

Bayer to pay $74 million for paying to delay generic Cipro

- September 24, 2013

- Consumer Fraud Insurance Disputes

Bayer Corporation and Bayer AG have agreed to pay $74,000,000 in a class action suit alleging defendants violated antitrust and consumer protection laws paying to keep lower-cost generic versions of Cipro off the market. If you or your company purchased or paid for Cipro in California between January 8, 1997...